42 pension plan definition

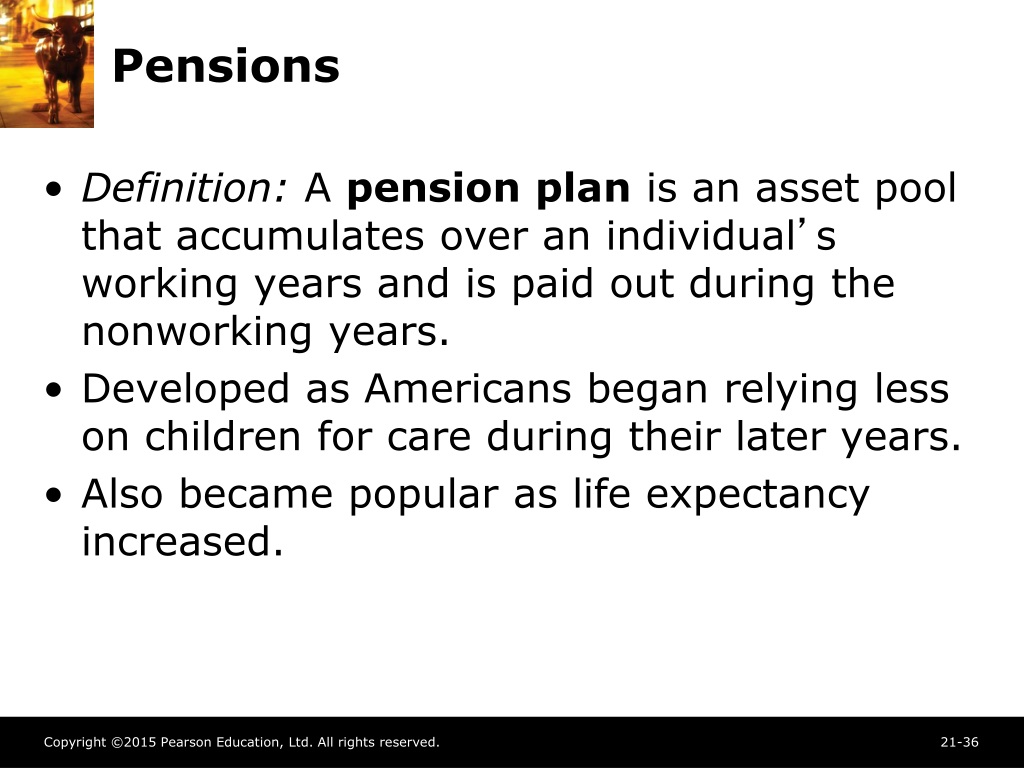

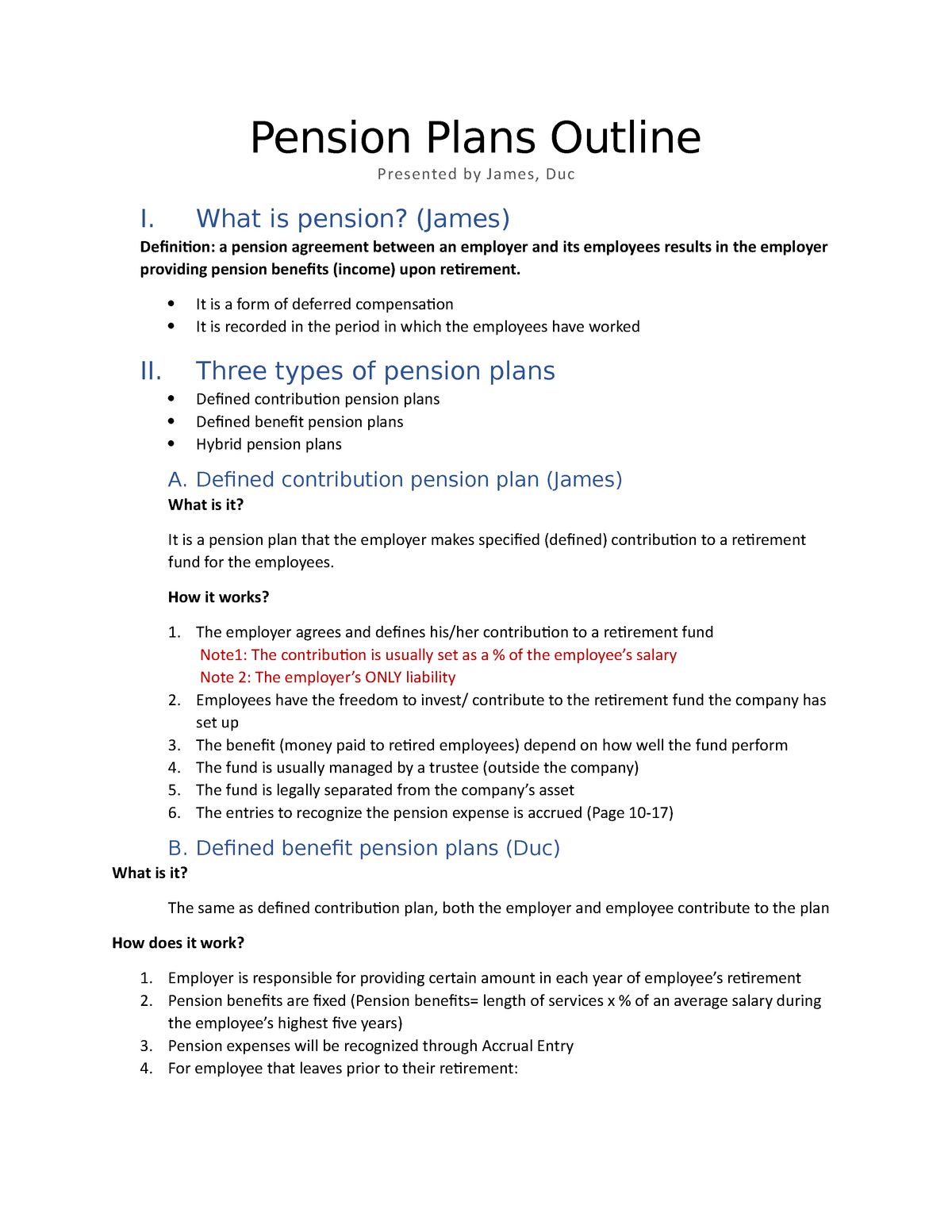

What is a Pension Plan? Pension Plan Definition A pension plan is the retirement amount, which an individual gets from their insurance companies on a regular basis or in the form of a lump sum. There are various types of such plans available in. the country offered by various companies. However, increased choices may confuse and person and make it difficult for individuals to choose one ... Pension Fund - Definition, Types, Benefits, How it Works? Pension Fund refers to any fund, plan, or scheme that is set up by an employer (or union) which generates regular income for employees after their retirement.

What Is a Pension and How Does It Work? - TheStreet A pension plan is a type of retirement plan where an employee adds money into a fund that includes contributions by the employer. The worker's pension payments are determined by the length of the ...

Pension plan definition

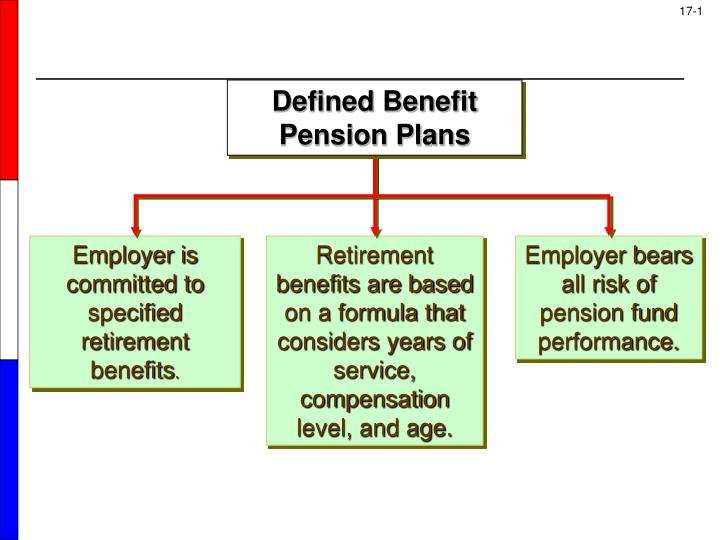

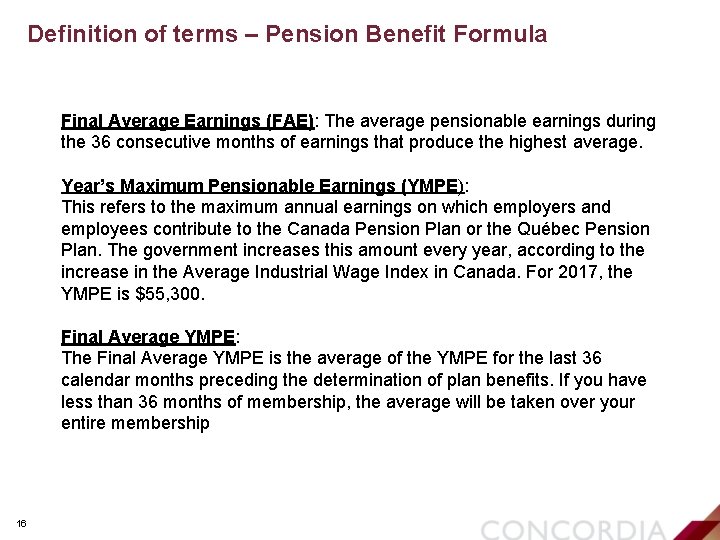

Defined-benefit pension legal definition of Defined ... Pension A benefit, usually money, paid regularly to retired employees or their survivors by private businesses and federal, state, and local governments. Employers are not required to establish pension benefits but do so to attract qualified employees. The first pension plan in the United States was created by the American Express Company in 1875. Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more ... ERISA Pension Plan Definition | Law Insider pension plan means any "employee pension benefit plan" (as such term is defined in section 3 (2) of erisa), other than a multiemployer plan, that is subject to title iv of erisa and is sponsored or maintained by the borrower or any erisa affiliate or to which the borrower or any erisa affiliate contributes or has an obligation to contribute, or …

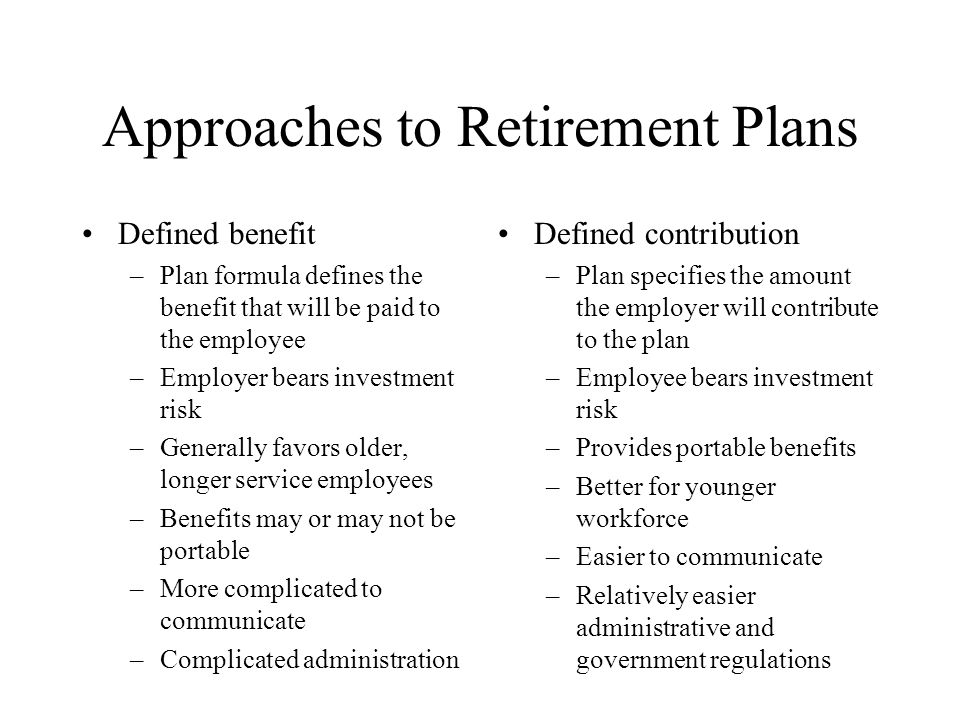

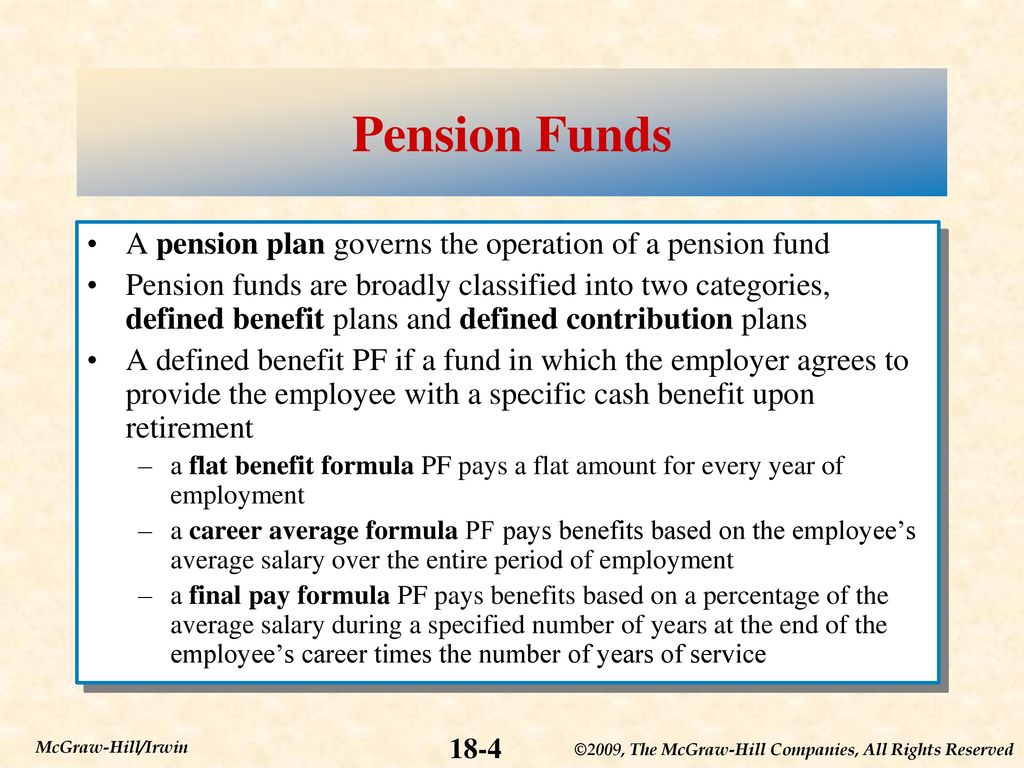

Pension plan definition. Pension Plan Definition - ThePressFree A pension plan is a retirement plan that requires an employer to make contributions to a pool of funds set aside for a worker's future benefit. There are two main types of pension plans: the defined benefit and the defined contribution plan. A defined benefit plan guarantees a set monthly payment for life (or a lump sum payment on retiring). Specified Canadian Pension Plan Definition | Law Insider Specified Canadian Pension Plan means any Canadian Pension Plan which contains a "defined benefit provision", as defined in subsection 147.1 (1) of the Income Tax Act (Canada). Pension Plan: Definition, Types and How They Work | PointCard A pension plan refers to a single plan extended to an individual. Plans are more costly than funds, which is explained below in greater detail. Employees have little to no control over the types of investments their money goes toward. Again, retirement payouts are computed based on an employee's final salary and their years with the company. 401(k) vs. Pension Plan: What's the Difference? On the other hand, a pension plan is commonly known as a defined-benefit plan, whereby the pension plan sponsor or your employer oversees the investment management and guarantees a certain amount...

What is a Qualified Pension Plan? - Definition from ... A qualified pension plan is a pension plan that meets the requirements of the Internal Revenue Code Section 401 and the Employee Retirement Income Security Act of 1974 (ERISA), making the individuals eligible for specific tax benefits. Pension Plan - Definition, Types, Benefits, 401K vs ... A pension plan is a retirement plan where the employer makes a guaranteed payment to the employee once they retire. The employee receives a specified income post-retirement every month derived from earnings on its employer's investments. Pension plan - definition of pension plan by The Free ... Define pension plan. pension plan synonyms, pension plan pronunciation, pension plan translation, English dictionary definition of pension plan. n. An arrangement for paying a pension to an employee, especially one funded fully or in large part by an employer. American Heritage® Dictionary of the... Pension Plan vs. 401(k): Types, Pros & Cons - NerdWallet What is a pension plan? A pension plan is a retirement-savings plan typically funded by an employer. Money goes into the pension on behalf of the employee while the employee works for the...

What Is a Pension Plan? - The Balance What Is a Pension Plan? A pension plan is an employer-sponsored retirement plan that provides income during retirement or upon the termination of a worker's employment. These can be offered in both the public and private sector, though they are becoming less common in the private sector. Defined-benefit pension plan financial definition of ... defined-benefit pension plan A pension plan in which retirement benefits rather than contributions into the plan are specified. Thus, a retired employee who has reached a certain age with a given number of years of service and has earned a certain income is entitled to a specific monthly pension payment. Pension Plan Definition: 22k Samples | Law Insider pension plan means any employee benefit plan, other than a multiemployer plan, which is subject to the provisions of title iv of erisa or section 412 of the code and which (a) is maintained, funded or administered for the employees of any credit party or any erisa affiliate or (b) has at any time within the preceding seven (7) years been … Pension Plan Definition Aug 30, 2021 · Allocated Funding Instrument: A specific type of insurance or annuity contract that pension plans use to purchase retirement benefits incrementally. The allocated funding instrument is funded with ...

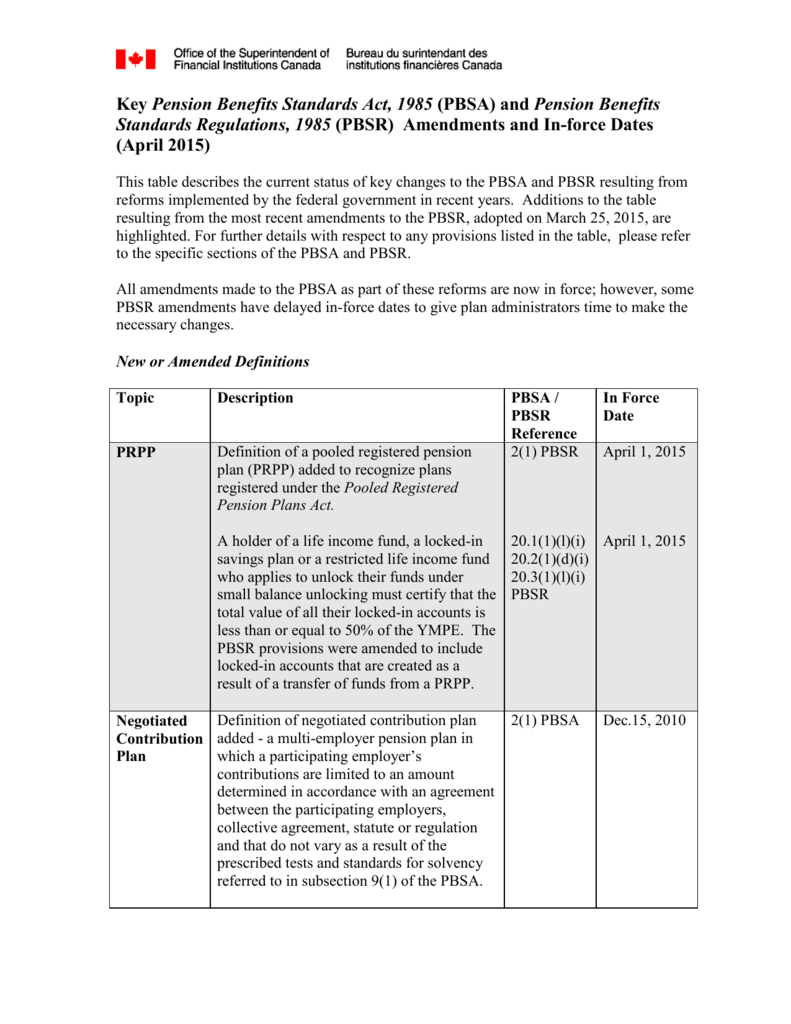

Definition of Employee Pension Benefit Plan Under ERISA Employee pension benefit plan. (a) General. This section clarifies the limits of the defined terms "employee pension benefit plan" and "pension plan" for purposes of Title I of the Act and this chapter by identifying certain specific plans, funds and programs which do not constitute employee pension benefit plans for those purposes.

Definition and Example of a Pension - The Balance Jan 25, 2022 · A pension is a retirement plan that provides a monthly income in retirement. Unlike a 401 (k), the employer bears all of the risk and responsibility for funding the plan. A pension is typically based on your years of service, compensation, and age at retirement. 401 (k)s, qualified longevity annuity contracts, and IRAs can serve as alternatives ...

What does pension plan mean? - definitions Definition of pension plan in the Definitions.net dictionary. Meaning of pension plan. Information and translations of pension plan in the most comprehensive dictionary definitions resource on the web.

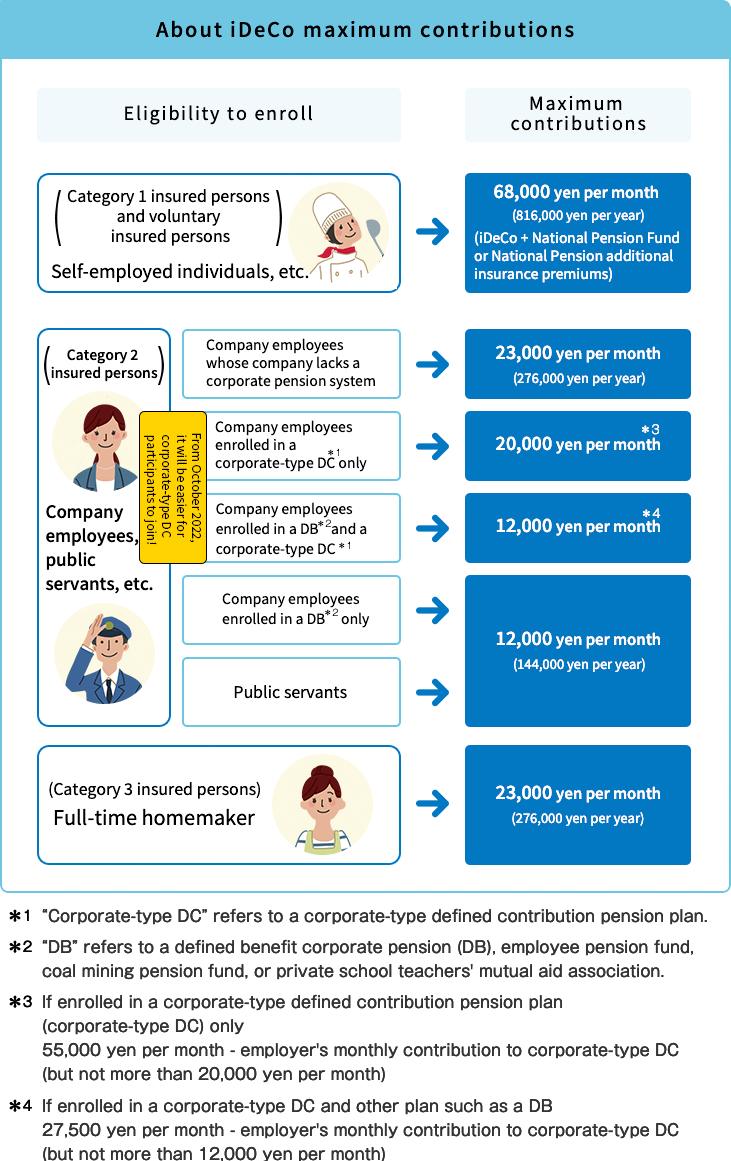

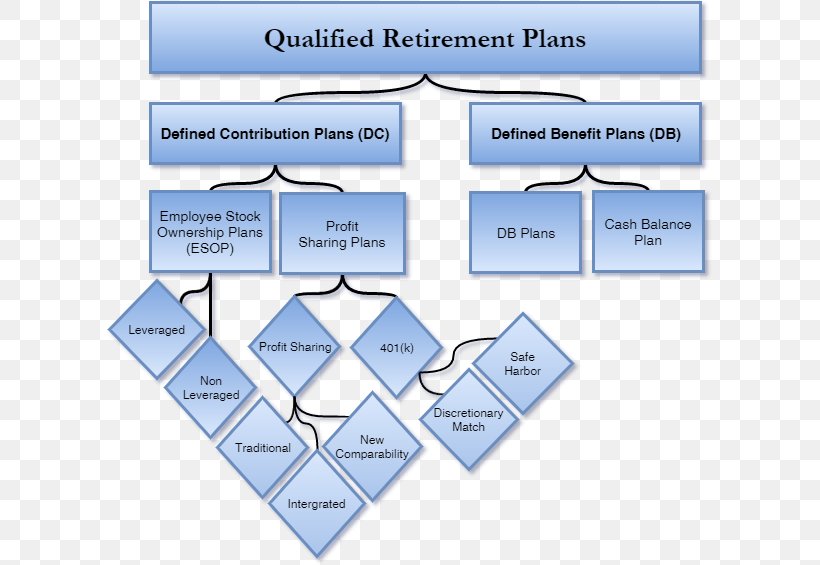

Types of Retirement Plans | Internal Revenue Service Individual Retirement Arrangements (IRAs) Roth IRAs. 401 (k) Plans. SIMPLE 401 (k) Plans. 403 (b) Plans. SIMPLE IRA Plans (Savings Incentive Match Plans for Employees) SEP Plans (Simplified Employee Pension) SARSEP Plans (Salary Reduction Simplified Employee Pension) Payroll Deduction IRAs.

Foreign Pension Plan Definition: 3k Samples | Law Insider Define Foreign Pension Plan. means any plan, fund (including, without limitation, any superannuation fund) or other similar program established or maintained outside the United States of America by the Borrower or any one or more of its Subsidiaries primarily for the benefit of employees of the Borrower or such Subsidiaries residing outside the United States of America, which plan, fund or ...

Pension Definition & Meaning - Merriam-Webster pension: [noun] a fixed sum paid regularly to a person:. wage. a gratuity granted (as by a government) as a favor or reward. one paid under given conditions to a person following retirement from service or to surviving dependents.

Pension plan Definition & Meaning - Merriam-Webster noun Save Word Definition of pension plan : an arrangement made with an employer to pay money to an employee after retirement Learn More About pension plan Share pension plan Dictionary Entries Near pension plan pension off pension plan pension scheme See More Nearby Entries Statistics for pension plan Cite this Entry "Pension plan."

What Is a Defined Benefit Plan? - SmartAsset A defined benefit plan is an employer-provided retirement program that pays employees fixed income payments when they retire. Here's how these plans work. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email Loading Home Buying Calculators How Much House Can I Afford? Mortgage Calculator Rent vs Buy Closing Costs Calculator

Pension Plans: Definition, Types, Benefits & Risks ... Nov 03, 2021 · Pension Plans: Definition, Types, Benefits & Risks. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. It’s different from a defined contribution plan, like a 401 (k), where employees put their own money in an employer-sponsored investment program.

Pension plan financial definition of pension plan A retirement plan in which an employer makes a contribution into an account each month. The contributions are invested on behalf of an employee, who may begin to make withdrawals after retirement. Typically, pensions are tax-deferred, meaning that the employee does not pay taxes on the funds in the pension until he/she begins making withdrawals. Pensions may have defined contributions, defined ...

ERISA Pension Plan Definition | Law Insider pension plan means any "employee pension benefit plan" (as such term is defined in section 3 (2) of erisa), other than a multiemployer plan, that is subject to title iv of erisa and is sponsored or maintained by the borrower or any erisa affiliate or to which the borrower or any erisa affiliate contributes or has an obligation to contribute, or …

Defined Benefit Plan | Internal Revenue Service Defined benefit plans provide a fixed, pre-established benefit for employees at retirement. Employees often value the fixed benefit provided by this type of plan. On the employer side, businesses can generally contribute (and therefore deduct) more each year than in defined contribution plans. However, defined benefit plans are often more ...

Defined-benefit pension legal definition of Defined ... Pension A benefit, usually money, paid regularly to retired employees or their survivors by private businesses and federal, state, and local governments. Employers are not required to establish pension benefits but do so to attract qualified employees. The first pension plan in the United States was created by the American Express Company in 1875.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/Senior_Raedle-56a9a64c3df78cf772a938a3.jpg)

![PDF] Personal pensions in the EU: Guidelines for an ...](https://d3i71xaburhd42.cloudfront.net/86a9dd015bba260bfaf19333c422f4e8fdf52b41/146-Table5-1.png)

/Balance_What_Happens_To_My_Pension_When_I_Leave_A_Job_2063411_V2-45fb62eb90d14d7c834a05988c0b4945.jpg)

/GM_Pension-2b3a5e03ee184c1a86e75a9ac4ebf2fd.png)

0 Response to "42 pension plan definition"

Post a Comment