41 this is the rate on a treasury bill or a treasury bond.

US Treasury Bonds Rates - Yahoo Finance Stocks tumble as red-hot inflation print pressures tech shares; 10-year Treasury yield nears 2%. Breaking News • Feb 10, 2022 Stock futures fall following red-hot inflation data: Nasdaq futures ... Treasury bill rates may go up ahead of retail bond ... RATES of Treasury bills (T-bills) could increase this week as the government's upcoming retail bond o ff er is expected to reduce liquidity in the market. The Bureau of the Treasury (BTr) will offer P15 billion in Treasury bills (T-bills) on Monday, or P5 billion each in 91-, 182- and 364-day securities.

Treasury Bills Notes and Bonds: Definition, How to Buy The Treasury Department pays the interest rate every six months for notes, bonds, and TIPS. Bills only pay interest at maturity. If you hold onto Treasurys until term, you will get back the face value plus the interest paid over the life of the bond. (You get the face value no matter what you paid for the Treasury at auction).

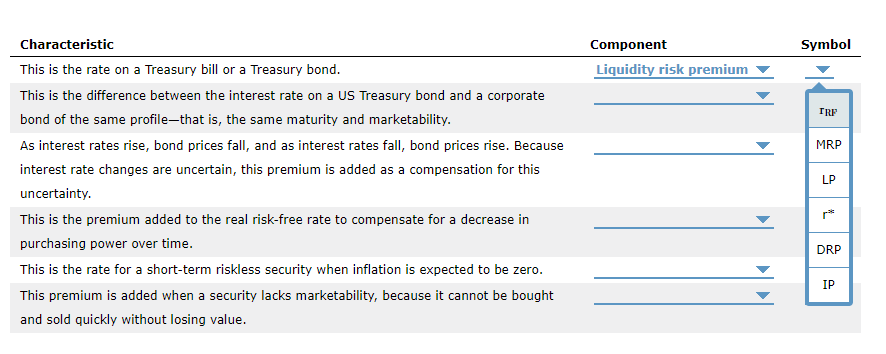

This is the rate on a treasury bill or a treasury bond.

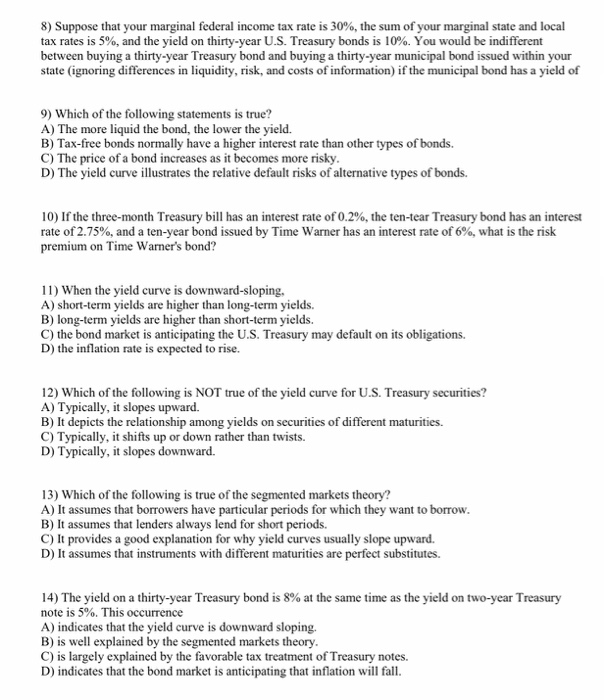

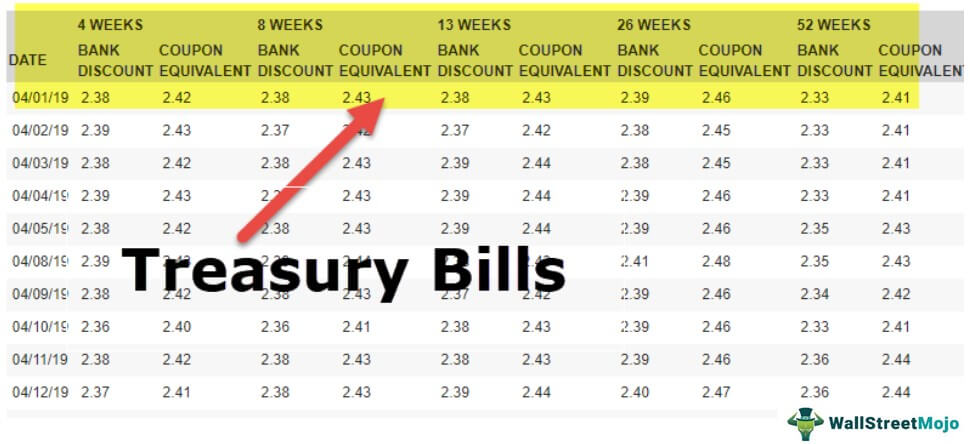

Treasury Bills vs Bonds | Top 5 Differences (with ... The interest rate on a T-bill is generally lesser than the interest rate for a bond as the tenure holding by the investor for the bond is higher, and also the risk is higher. Treasury Bills vs. Bonds Comparative Table 10-year Treasury yields rise above 2% as market monitors ... The 2-year Treasury note rate TMUBMUSD02Y, 1.623% was at 1.616%, up from 1.544% a day ago. The 30-year Treasury bond yield TMUBMUSD30Y, 2.304% was at 2.322%, up slightly from 2.291% on Thursday ... Daily Treasury Bill Rates Data Daily Treasury Bill Rates: These rates are the daily secondary market quotations on the most recently auctioned Treasury Bills for each maturity tranche (4-week, 8-week, 13-week, 26-week, and 52-week) for which Treasury currently issues new bills. Market quotations are obtained at approximately 3:30 PM each business day by the Federal Reserve Bank of New York.

This is the rate on a treasury bill or a treasury bond.. Are 10 Year Treasury Bonds Taxable? - TheMoneyFarm Floating rate notes (FRNs) issued by the US Treasury are debt instruments with a variable coupon payment. The rate is based on the discount rate on 13-week Treasury bills. FRNs have a two-year maturity and pay interest and adjust payments quarterly. FRNs can also be bought and sold on the secondary market. What Is The Current Return On Treasury Bills 3 How much interest can you earn from a treasury bill? 4 What is the current 3 month treasury bill rate? 5 Do treasury bills have high returns? 6 What is the 91-day treasury bill rate? 7 Is it a good time to buy treasury bills? 8 What is 90 day treasury bill? 9 What is the 1 year Treasury rate today? 10 Are Treasury bills and bonds the same? India says it will borrow more via treasury bills in March The government will now issue short-term treasury bills worth 1.86 trillion rupees ($24.75 billion) between March 2 and March 31, it said in a press release late on Friday, compared with the 1.26 ... Treasury yields are steady as Russia-Ukraine tensions escalate The yield on the benchmark 10-year Treasury note moved 1 basis point higher to 1.934% at around 4:00 p.m. ET. The yield on the 30-year Treasury bond fell 1 basis point to 2.238%. Yields move ...

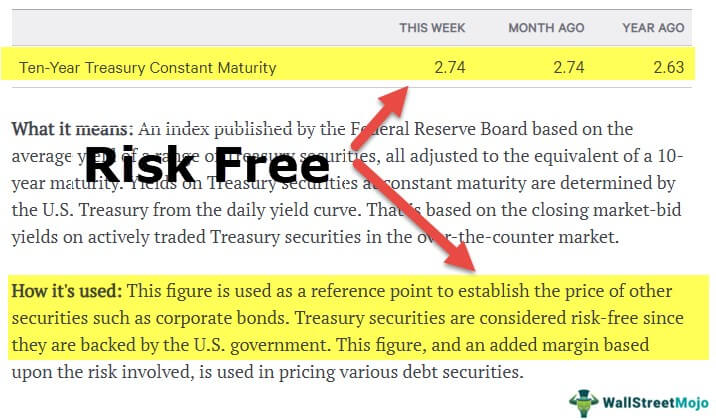

Solved Characteristic Component Symbol This is the rate on ... Characteristic Component Symbol This is the rate on a Treasury bill or a Treasury bond. It changes over time, depending on the expected rate of return on productive assets exchanged among market participants and people's time preferences for consumption. India says it will borrow more via treasury bills in March ... The government will now issue short-term treasury bills worth 1.86 trillion rupees ($24.75 billion) between March 2 and March 31, it said in a press release late on Friday, compared with the 1.26 ... What is a Treasury bond? As of August 2021, the average interest rate paid out on 30-year U.S. Treasury bonds was 1.92 percent. That said, Treasury bond rates do rise and fall for a variety of reasons. Beat Inflation With A Risk Free 7% U.S. Treasury Bond This compares to a one-year U.S. Treasury Bill paying 0.26% per year and the highest one-year CD on bankrate.com paying 0.67%. There are some "drawbacks" to Series I Bonds While 7.12% is a...

What Is a Treasury Bill? How Treasury Bills Work and What ... Government securities with a fixed interest rate that pays every 6 month and is guaranteed by the United States Treasury Department are known as Treasury Bonds. T-bonds have maturities of 20-30 years. Both are guaranteed by the United States Government. The bonds are sold by the U.S. Treasury regularly on auction sites just like the T-bills. Solved This is the rate o short-term U. S. treasury ... It is based on the bond's rating; the higher the rating, the lower the premium added, thus lowering the interest rate. This is the rate on a treasury bill or a treasury bond. This is the premium added to the real risk-free rate to compensate for a decrease in purchasing power over time Previous question Next question Treasury Bills (T-Bills) Definition - investopedia.com On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face value. In other words, it would cost approximately $970 for a $1,000 T-bill. What are the... Treasury Bonds vs. Treasury Notes vs. Treasury Bills Note Auction: A formal bidding process that is scheduled on a regular basis by the U.S. Treasury. Currently there are 17 authorized securities dealers (primary dealers) that are obligated to bid ...

Investing in Treasury Bills: The Safest Investment in 2022 Secondly, as per the U.S. Treasury website, the highest interest rate on a T-bill is around 0.10%. Either way you slice it, you are not going to be living in retirement off of Treasury bills. However, for the longer-term T-notes and T-bonds, interest is paid every six months.

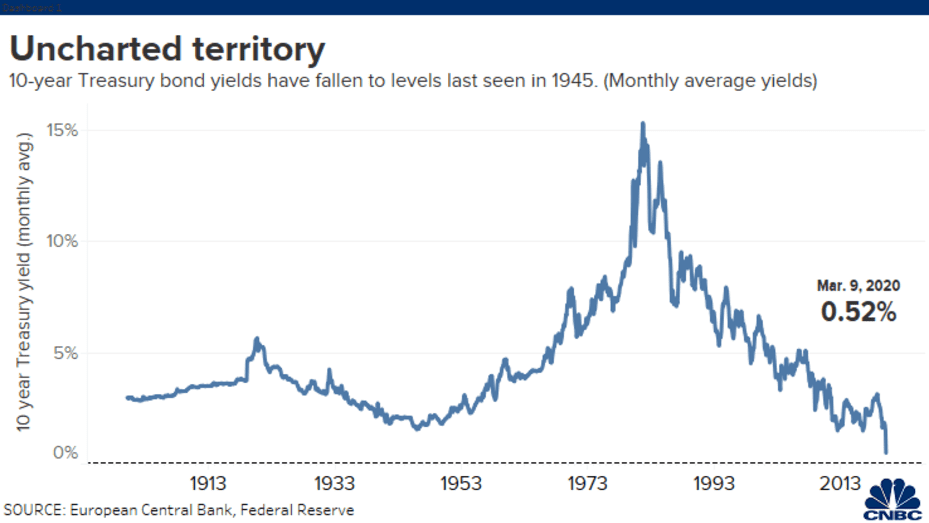

U.S. bonds: Treasury yields fall sharply as Russia invades ... The yield on the benchmark 10-year Treasury note was down roughly 2 basis points to 1.96% at around 2:30 p.m. ET. Shorter-term yields show held on to larger declines, but the yield on the 30-year ...

U.S. Treasury Imposes Immediate Economic Costs in Response ... Pursuant to E.O. 14024, the Secretary of the Treasury, in consultation with the Secretary of State, has determined that section 1(a)(i) of E.O. 14024 applies to the financial services sector of the Russian Federation economy, and that persons determined to operate or have operated in this identified sector can be subject to sanctions.

Treasury Bond (T-Bond) - Overview, Mechanics, Example A Treasury bond (or T-Bond) is a long-term government debt security issued by the U.S. Treasury Department with a fixed rate of return. Maturity periods range from 20 to 30 years. T-bond holders receive semi-annual interest payments (called coupons) from inception until maturity, at which point the face value of the bond is also repaid.

Treasury Bills vs Bonds | Top 5 Best Differences (With ... Treasury bills are short term money market instruments whereas Treasury Bonds are long term capital market instruments. Treasury bills are issued at a discounted price whereas Treasury Bonds pay interest every six months to holders of a bond. Treasury bills mature in a year or less whereas Treasury bonds have a maturity greater than 10 years.

What Is a Treasury Bill, a US Savings Bond & a Revenue ... For example, if you purchase a year-bill at an interest rate of 1.5 percent, the cost is $985 and you receive $1,000 at maturity, which includes your $15 interest payment. You don't pay state or ...

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates. These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates.

Treasury bill rates to climb as liquidity shifts to retail ... Treasury bill rates to climb as liquidity shifts to retail bonds. RATES of Treasury bills (T-bills) may go up this week as the government's ongoing retail bond offer continues to siphon off market liquidity. The Bureau of the Treasury (BTr) will offer P15 billion in T-bills on Monday, or P5 billion each in 91-, 182- and 364-day securities.

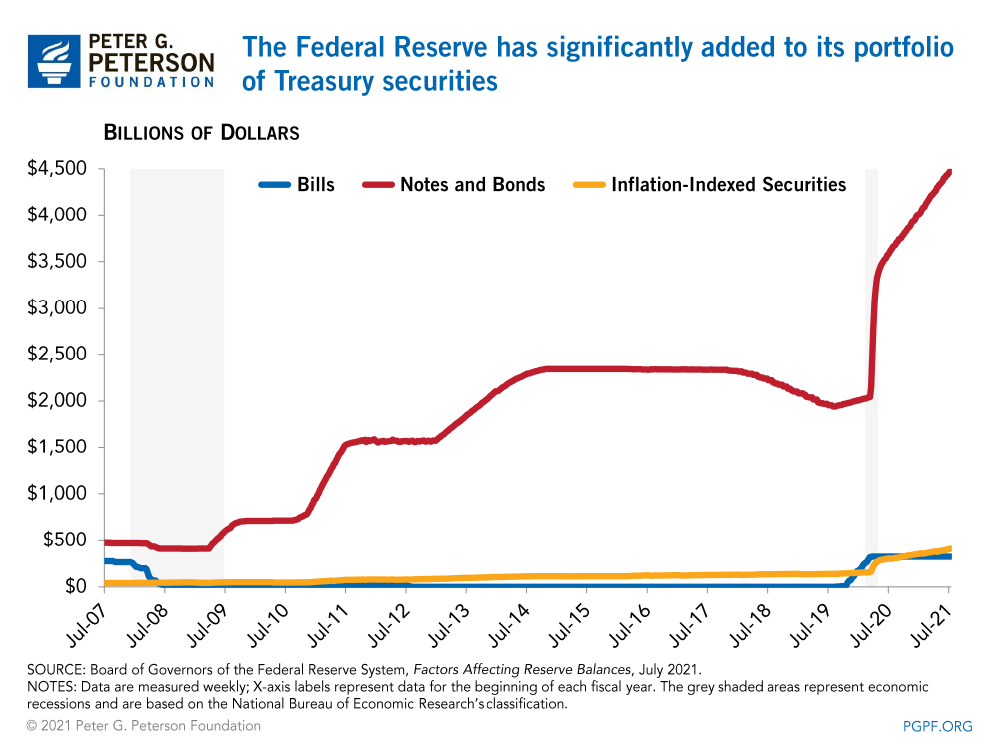

Average Interest Rates on U.S. Treasury Securities | U.S ... Its primary purpose is to show the average interest rate on a variety of marketable and non-marketable Treasury securities. Marketable securities consist of Treasury Bills, Notes, Bonds, Treasury Inflation-Protected Securities (TIPS), Floating Rate Notes (FRNs), and Federal Financing Bank (FFB) securities.

Treasury Bills vs. Bonds: What's the Difference? Government-backed Debt Securities Type of Security Maturity Period When Interest is Paid Minimum Treasury bill 4, 8, 13, 26 or 52 weeks At maturity $100 Treasury bond 30 years Every 6 months $100 ...

Treasury Bills - Guide to Understanding How T-Bills Work The amount of profit earned from the payment is considered the interest earned on the T-bill. The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value.

Daily Treasury Bill Rates Data Daily Treasury Bill Rates: These rates are the daily secondary market quotations on the most recently auctioned Treasury Bills for each maturity tranche (4-week, 8-week, 13-week, 26-week, and 52-week) for which Treasury currently issues new bills. Market quotations are obtained at approximately 3:30 PM each business day by the Federal Reserve Bank of New York.

10-year Treasury yields rise above 2% as market monitors ... The 2-year Treasury note rate TMUBMUSD02Y, 1.623% was at 1.616%, up from 1.544% a day ago. The 30-year Treasury bond yield TMUBMUSD30Y, 2.304% was at 2.322%, up slightly from 2.291% on Thursday ...

Treasury Bills vs Bonds | Top 5 Differences (with ... The interest rate on a T-bill is generally lesser than the interest rate for a bond as the tenure holding by the investor for the bond is higher, and also the risk is higher. Treasury Bills vs. Bonds Comparative Table

/10-year-treasury-note-3305795-Final-b5449ca2619747788f6366ccebd81ca7.png)

/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

0 Response to "41 this is the rate on a treasury bill or a treasury bond."

Post a Comment