41 defined contribution pension death

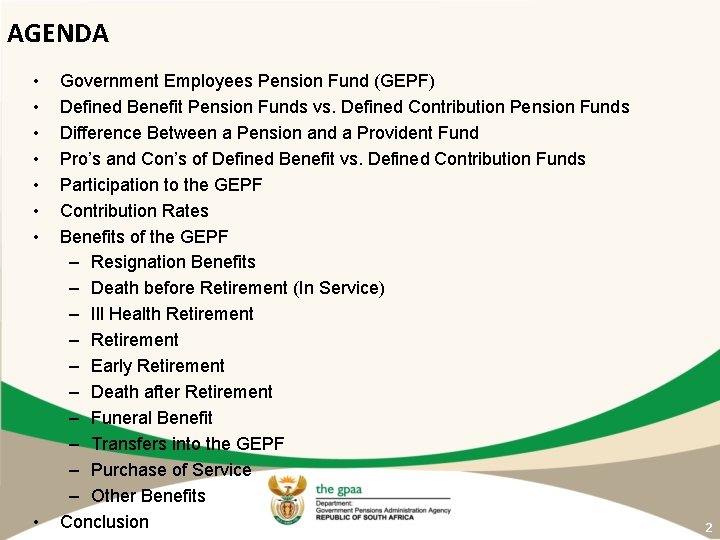

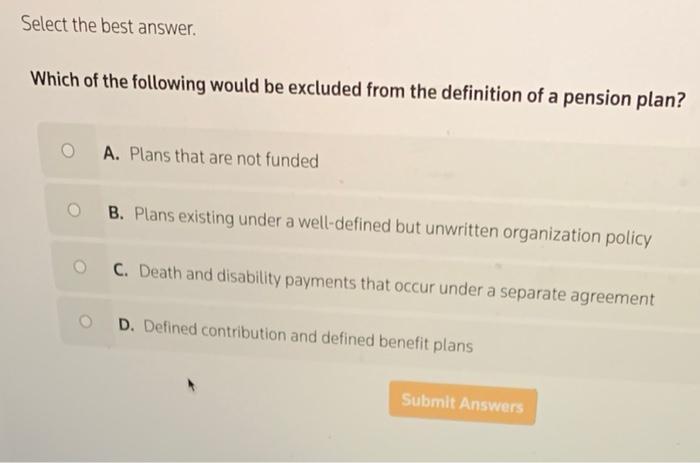

Are Pension Death Benefits Taxable? - HelpAdvisor If pension death benefits involve a defined-contribution plan such as a 401(k) or are paid as a lump sum distribution, there may be an option to roll them over into a new retirement plan. Rollovers may allow beneficiaries the option to continue growing their income in a tax-deferred environment until they're ready to begin receiving payments. Death benefits from a defined benefit pension scheme | Tax ... Death benefits from a defined benefit pension scheme Introduction. On the death of a scheme member or a beneficiary, a registered pension scheme is only authorised to pay out benefits to a beneficiary either as a pension death benefit or as a lump sum death benefit.

Pension contribution limits | PensionBee Jul 07, 2021 · Up to the pension contribution limit, you receive generous pension tax relief on your contributions. The amount you receive depends on your income tax bracket: you automatically get a 25% tax top up, but you can claim a further 25% or 31% through your tax return if you’re a higher or additional rate taxpayer.

Defined contribution pension death

What happens to my pension when I die? | MoneyHelper Defined benefit pension schemes might also pay a refund of the contributions paid by the member, if the member dies before starting to draw their pension. This is subject to the scheme's rules. Interest might also be added to the refund of contributions under some scheme's rules. Pension protection lump sum Considering a pension transfer: defined benefit | FCA Jul 19, 2021 · In a defined contribution (DC) pension, you invest funds to build up a personal pot of money. You can choose how to use your pot to give you allowable tax-free lump sums and your retirement income . The value of your pension pot is affected by changes in the value of the assets you invest in - such as shares, bonds and property - and it will go ... Chancellor abolishes 55% tax on pension funds at death ... Around 320,000 people retire each year with defined contribution pension savings; these people will no longer have to worry about their pension savings being taxed at 55% on death.

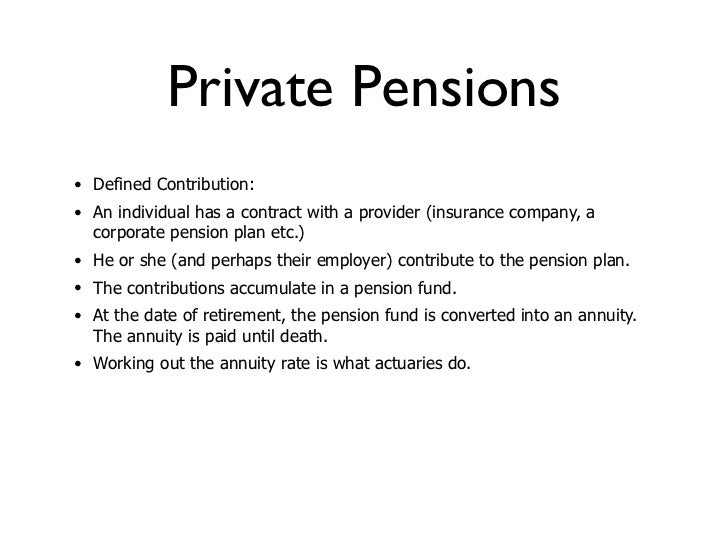

Defined contribution pension death. Defined contribution pensions - BDO Relaxation of tax charges for pension funds on death after age 75 It has long been the case that if an individual dies before taking any pension benefits (and before age 75), the fund remains outside the individual's estate for inheritance tax (IHT) purposes and there is no exit charge on funds paid to their nominated beneficiaries. Inherited Pension Benefit Payments From Deceased Parents A defined-contribution plan is a retirement plan that's typically tax-deferred, like a 401 (k) or a 403 (b) , in which employees contribute a fixed amount or a percentage of their paychecks to an... Options for using your defined contribution pension pot You now have more choice and flexibility in how and when you can take money from your defined contribution pension pot. It’s important to understand your options because what you decide now will affect your retirement income for the rest of your life. PDF Defined Contribution Pension Plan Death Benefit Application Defined Contribution Pension Plan Death Benefit Application _____ Complete all applicable sections and return pages 1-3 to: Southern California Pipe Trades Administrative Corporation Defined Contribution Department 501 Shatto Place, 5th Floor Los Angeles, CA 90020 Save "Your Rollover Options" for your records. (800) 595-7473 OR (213) 385-6161

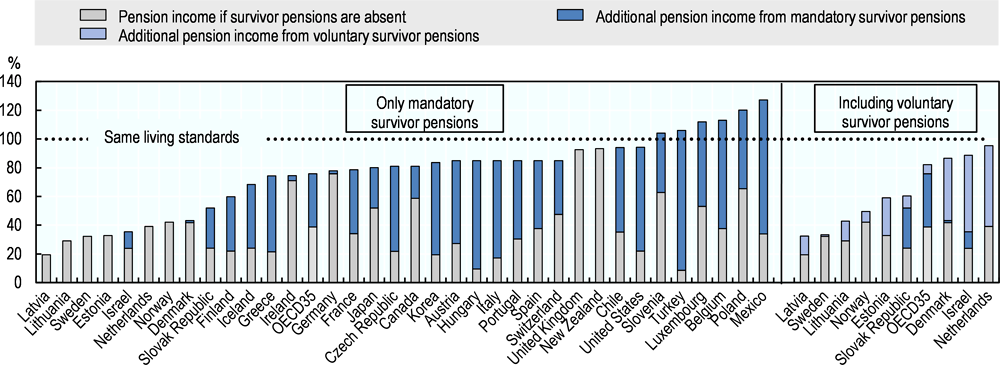

Defined Benefit | When a member dies - Pension With a survivor pre-retirement and dependent children. Your survivor pre-retirement will receive a monthly pension equal to at least 50% of your unreduced pension or a commuted value. Each dependent child will receive a monthly pension equal to 10% of your unreduced pension, to a maximum of 40% shared equally among all dependent children. Tax on a private pension you inherit - GOV.UK A pension from a defined benefit pot can usually only be paid to a dependant of the person who died, for example a husband, wife, civil partner or child under 23. It can sometimes be paid to... Defined-Benefit vs. Defined-Contribution Plan Differences As the names imply, a defined-benefit plan—also commonly known as a traditional pension plan —provides a specified payment amount in retirement. A defined-contribution plan allows employees ... What happens to your pension when you die? - Aviva A defined contribution pension — a pension that's based on how much has been paid into it — will normally pay the value of your pension pot in a lump sum to your dependants. If you die before age 75, benefits under money purchase schemes can usually be passed on to your beneficiaries free of tax.

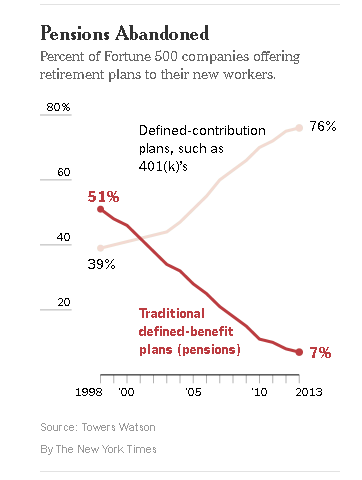

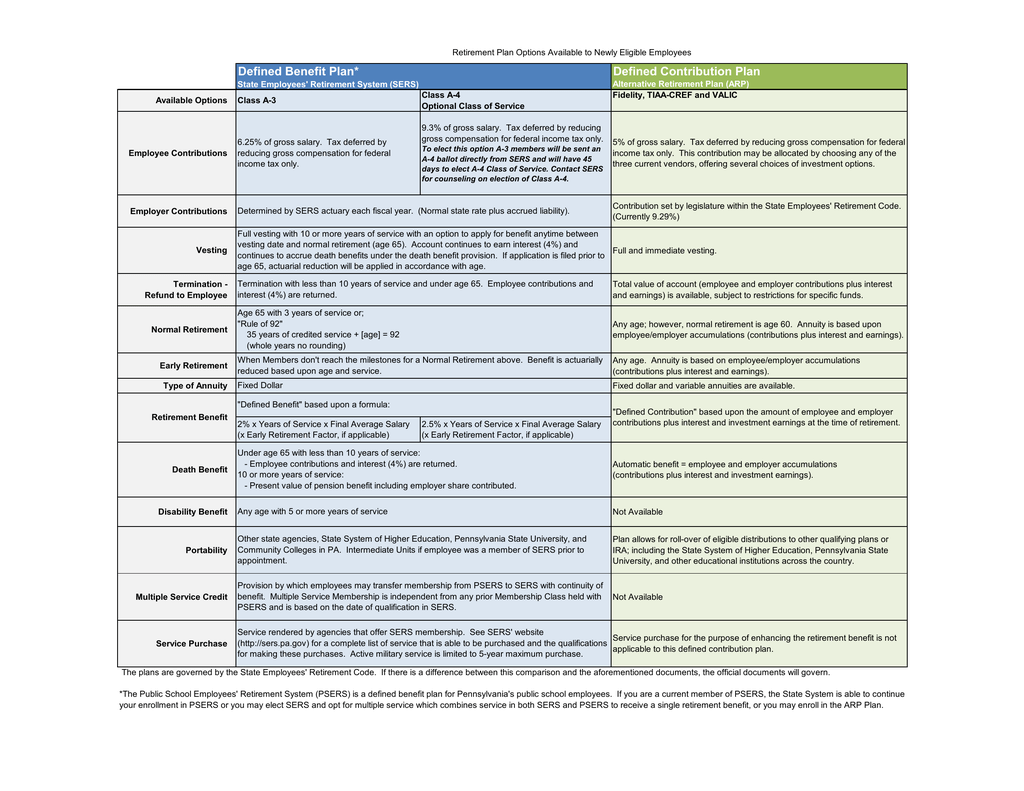

Defined-Contribution Plan Definition The defined-contribution plan differs from a defined-benefit plan, also called a pension plan, which guarantees participants receive a certain benefit at a specific future date. Retirement Topics - Death | Internal Revenue Service ERISA protects surviving spouses of deceased participants who had earned a vested pension benefit before their death. The nature of the protection depends on the type of plan and whether the participant dies before or after payment of the pension benefit is scheduled to begin, otherwise known as the annuity starting date. What is a defined benefit pension? | Final salary pension Dec 08, 2021 · A defined benefit pension (also called a 'final salary' pension) is a type of workplace pension that pays you a retirement income based on your salary and the number of years you’ve worked for the employer, rather than the amount of money you’ve contributed to the pension. Home - Civil Service Pension Scheme Introducing the new Civil Service Pensions Website. We have totally redesigned and rebuilt our website from the ground up. Our aim was to make it easier and quicker than ever for you to find the information and support you need to manage, understand and maximise the benefits of your biggest employment benefit after your salary – your Civil Service Pension.

Death Benefits - Defined Contribution Schemes Death Benefits - Defined Contribution Schemes. ... How pension death benefits are treated depends on the age at death and the timeframe with which any death benefits are paid out. Death benefits and the Lifetime Allowance A lifetime allowance charge may apply to benefits where:

What to do about someone's pension when they've died ... Defined contribution and defined benefit pensions provide different benefits on death. You need to contact the pension provider, or employer, if it's a workplace scheme, to find out how much the deceased had and how to claim that pension.

What is a defined contribution pension? | PensionBee What is a defined contribution pension? A defined contribution pension is the most common type of pension. On retirement, the amount your defined contribution pension is worth depends on how much money you've contributed and the performance of your investments. Most modern workplace and personal pensions are defined contribution pensions.

What happens to my pensions after death? | The Private Office If you have built up substantial funds in your pensions during your working life and have not taken any benefits from them and subsequently die before your 75th birthday your defined contribution pension funds and any defined benefit lump sums will be tested against your Lifetime Allowance.

search - Pennsylvania State Employees' Retirement System The Pennsylvania State Employees' Retirement System, serving our members since 1923

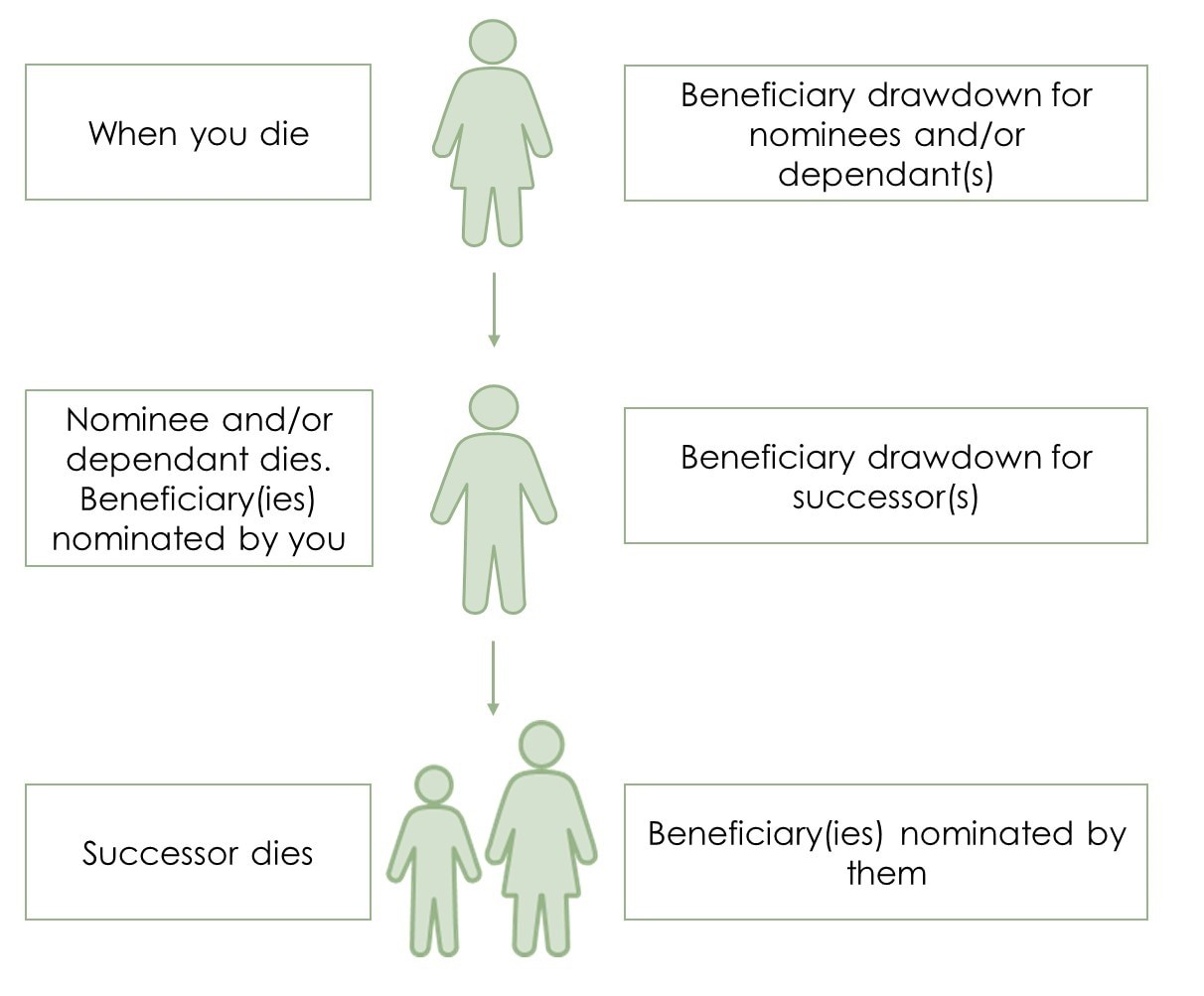

Death benefits from defined contribution schemes Defined contribution schemes usually offer lump sum and income death benefits. Each scheme will define the treatment of benefits on the death of a member and each scheme may be different. Death benefits from occupational defined contribution schemes may not offer full flexibility of death benefits.

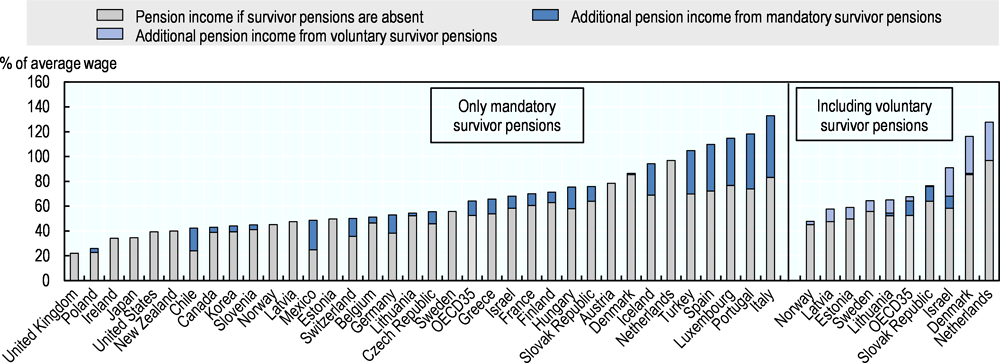

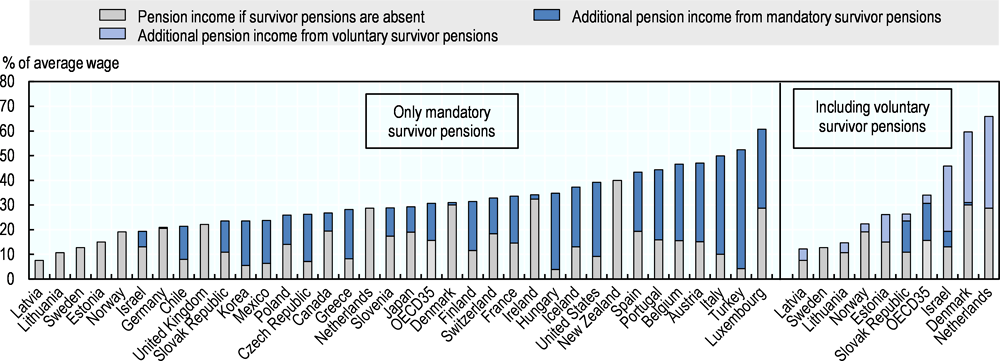

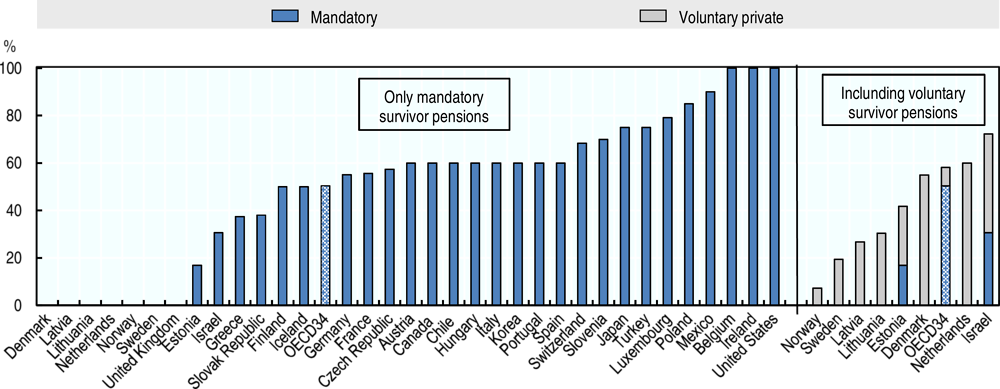

Pension fund - Wikipedia The pension system in Romania is made of three pillars. One is the state pension (Pillar I – Mandatory), the second is a private mandatory pension where the state transfers a percentage of the contribution it collects for the public pension, and the third is an optional private pension (Pillar III – Voluntary).

Pension death benefits 'indefensibly generous' | Financial ... Rule changes in 2015 allowed any unused cash left in a defined contribution personal pension to be passed to beneficiaries and heirs tax free if the pension holder died before the age of 75.

What happens to your pension when you die? | PensionBee Defined contribution pensions The main pension rule governing defined contribution pensions in death is your age when you die and whether you've already started drawing your pension. If you die before your 75th birthday and haven't started drawing your pension it can be passed to your beneficiaries tax-free.

Chancellor abolishes 55% tax on pension funds at death ... Around 320,000 people retire each year with defined contribution pension savings; these people will no longer have to worry about their pension savings being taxed at 55% on death.

Considering a pension transfer: defined benefit | FCA Jul 19, 2021 · In a defined contribution (DC) pension, you invest funds to build up a personal pot of money. You can choose how to use your pot to give you allowable tax-free lump sums and your retirement income . The value of your pension pot is affected by changes in the value of the assets you invest in - such as shares, bonds and property - and it will go ...

What happens to my pension when I die? | MoneyHelper Defined benefit pension schemes might also pay a refund of the contributions paid by the member, if the member dies before starting to draw their pension. This is subject to the scheme's rules. Interest might also be added to the refund of contributions under some scheme's rules. Pension protection lump sum

0 Response to "41 defined contribution pension death"

Post a Comment